Asian Institutions Shift Focus Towards Stablecoins Amid Crypto Market Evolution

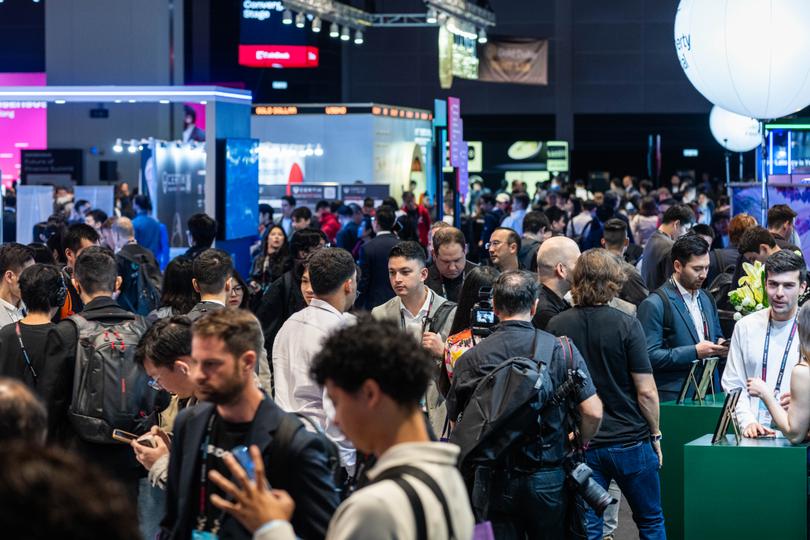

A growing trend among Asian institutions is emerging as they increasingly pivot towards stablecoins, reflecting a significant shift in the crypto landscape. This movement, highlighted by insights from Consensus experts, underscores the evolving role of stablecoins in financial markets.

Introduction

In a notable shift within the cryptocurrency landscape, Asian institutions are increasingly embracing stablecoins as a means to navigate the volatile market. This trend, highlighted by experts at Consensus, indicates a growing recognition of stablecoins as a reliable alternative for institutional investment and transaction facilitation.

The Rise of Stablecoins

Stablecoins, cryptocurrencies designed to maintain a stable value by pegging them to a reserve of assets, have gained traction among institutions seeking to mitigate the risks associated with traditional cryptocurrencies like Bitcoin and Ethereum. As the crypto market continues to experience fluctuations, the demand for stablecoins has surged, providing a more predictable and secure option for investors.

Institutional Interest in Stablecoins

According to recent insights from Consensus, several Asian financial institutions are pivoting towards stablecoins for various reasons, including enhanced liquidity, reduced transaction costs, and improved regulatory compliance. These institutions are recognizing the potential of stablecoins to facilitate cross-border transactions and streamline payment processes, making them an attractive choice in the rapidly evolving financial landscape.

Regulatory Landscape

The regulatory environment surrounding cryptocurrencies remains a critical factor influencing institutional adoption. In Asia, countries like Hong Kong and Singapore have established frameworks that support the use of stablecoins, fostering an environment conducive to innovation and investment. As regulators continue to develop guidelines for digital assets, institutions are increasingly confident in integrating stablecoins into their operations.

Market Implications

The growing interest in stablecoins among Asian institutions is expected to have significant implications for the broader cryptocurrency market. As more institutional players enter the space, the demand for stablecoins is likely to increase, leading to greater liquidity and stability. This shift could also pave the way for more innovative financial products and services, further integrating cryptocurrencies into mainstream finance.

Challenges Ahead

Despite the promising outlook for stablecoins, challenges remain. Issues such as regulatory uncertainty, concerns over the transparency of reserves, and the potential for market manipulation continue to pose risks. Institutions must navigate these challenges while leveraging the benefits that stablecoins offer.

Conclusion

As Asian institutions increasingly pivot towards stablecoins, the landscape of the cryptocurrency market is evolving. This trend reflects a broader acceptance of digital assets within traditional finance, highlighting the potential for stablecoins to play a pivotal role in the future of financial transactions. With ongoing developments in regulation and technology, the future of stablecoins in Asia looks promising, paving the way for a new era of financial innovation.