Eastroc Beverage Explores Billion-Dollar Hong Kong Listing Amid Growing Market Interest

Eastroc Beverage, a prominent Chinese drinks manufacturer, is reportedly assessing investor interest for a potential listing in Hong Kong that could exceed a billion dollars. This move comes as the company seeks to capitalize on the burgeoning beverage market and enhance its global footprint.

Introduction

In a significant development in the beverage sector, Eastroc Beverage, a leading Chinese drinks manufacturer, is reportedly gauging interest for a potential listing in Hong Kong that could surpass a billion dollars. This strategic move aims to tap into the growing global demand for beverages and strengthen the company's market position.

Company Background

Founded in 1996, Eastroc Beverage has established itself as a key player in the Chinese beverage market, particularly known for its popular energy drinks and other non-alcoholic beverages. With a robust distribution network and a diverse product portfolio, the company has consistently expanded its market share within China and is now looking to broaden its horizons internationally.

Market Context

The beverage industry has witnessed a remarkable transformation in recent years, driven by changing consumer preferences towards healthier and more functional drinks. This shift has prompted companies like Eastroc to innovate and diversify their offerings, positioning themselves to capture a larger share of the market. Analysts note that the global beverage market is projected to continue its growth trajectory, making it an opportune time for Eastroc to consider an initial public offering (IPO).

Listing Plans

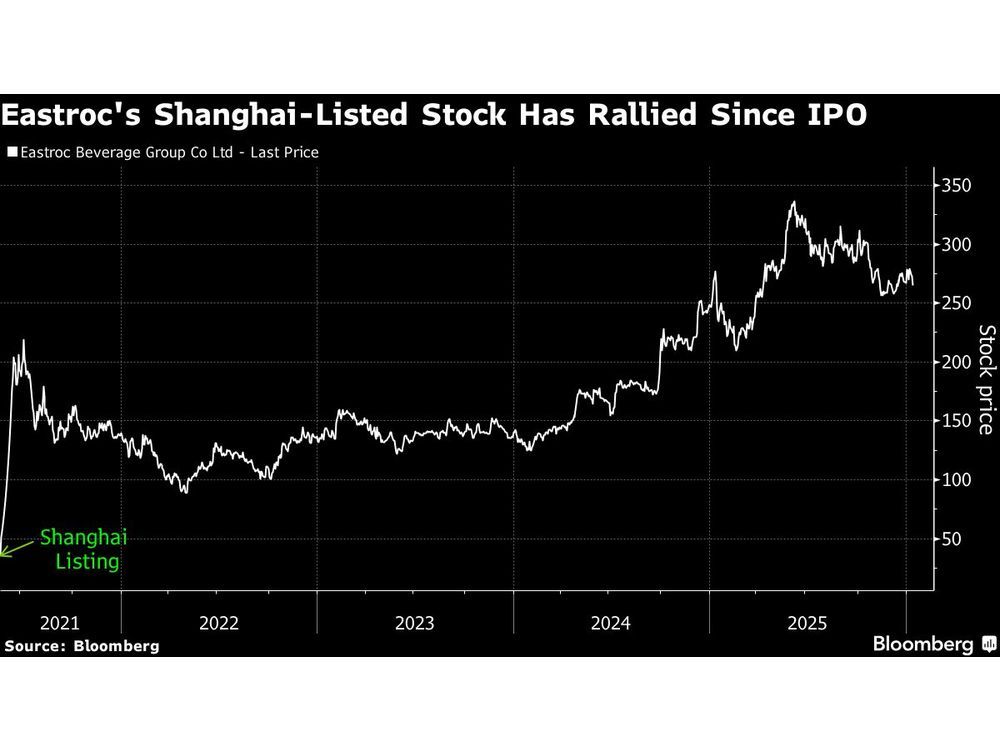

According to sources familiar with the matter, Eastroc Beverage is currently assessing potential investor interest as part of its preparations for a Hong Kong IPO. The company aims to raise significant capital that would not only facilitate its expansion plans but also enhance its brand visibility in the competitive beverage landscape. The decision to list in Hong Kong is strategic, given the city's status as a major financial hub with a robust investor base.

Financial Projections

While specific financial details regarding the IPO remain under wraps, industry experts suggest that Eastroc could aim for a valuation exceeding one billion dollars. This valuation would reflect the company's strong sales performance and growth potential in both domestic and international markets. The funds raised from the IPO are expected to be directed towards research and development, marketing initiatives, and expanding production capabilities.

Competitive Landscape

Eastroc Beverage operates in a highly competitive environment, with numerous domestic and international players vying for market share. Notable competitors include well-established brands such as Red Bull and Monster Energy, which dominate the energy drink segment. To differentiate itself, Eastroc has focused on product innovation and sustainability, appealing to health-conscious consumers who are increasingly seeking natural ingredients and environmentally friendly packaging.

Future Prospects

As Eastroc Beverage embarks on this potential IPO journey, the company is poised to leverage its strong brand equity and market expertise to attract investors. The anticipated listing not only underscores the company's ambition to scale its operations but also reflects the broader trend of Chinese companies seeking to access international capital markets. With a growing emphasis on transparency and corporate governance, Eastroc's move could set a precedent for other Chinese firms contemplating similar paths.

Conclusion

In conclusion, Eastroc Beverage's exploration of a billion-dollar IPO in Hong Kong marks a pivotal moment for the company and the beverage industry at large. As consumer preferences evolve and the market continues to expand, Eastroc's strategic decision to list could pave the way for future growth and innovation. Stakeholders and investors will be closely monitoring developments as the company navigates this exciting phase in its corporate journey.