Hong Kong Set to Issue First Stablecoin Licenses in March 2024

Hong Kong's Financial Secretary announced the city will begin issuing licenses for stablecoin operations in March 2024, marking a significant step in the regulation of digital currencies. This initiative aims to position Hong Kong as a global hub for cryptocurrency innovation and financial technology.

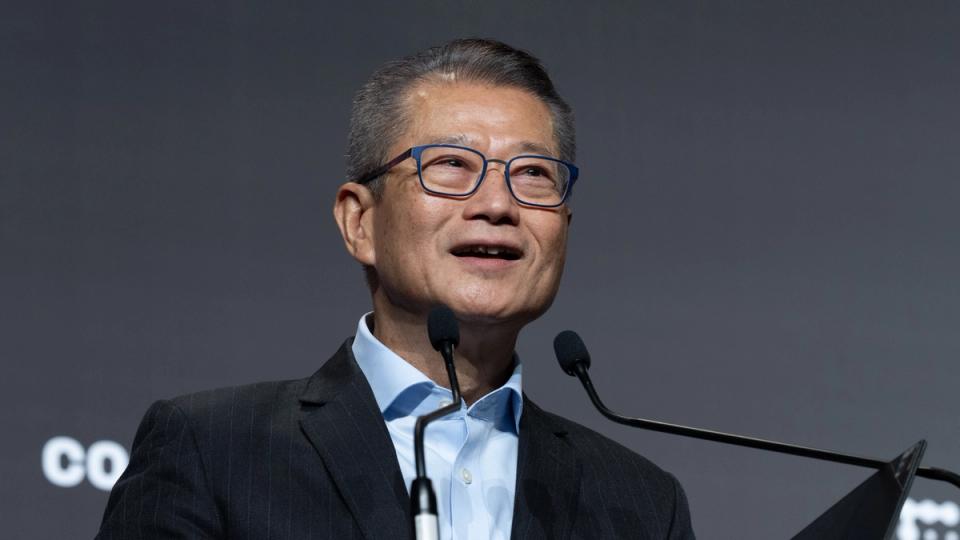

Hong Kong's Financial Secretary Unveils Stablecoin Licensing Plans

In a groundbreaking announcement, Hong Kong's Financial Secretary, Paul Chan, revealed that the city is preparing to issue its first licenses for stablecoin operations starting in March 2024. This move is part of a broader strategy to regulate the burgeoning cryptocurrency market and enhance Hong Kong's position as a leading global financial hub.

Regulatory Framework for Stablecoins

The licensing framework aims to establish clear guidelines for stablecoin issuers, ensuring that they adhere to stringent regulatory standards. This initiative comes in response to the rapid growth of digital currencies and the increasing demand for stablecoin solutions, which are pegged to traditional currencies like the US dollar to mitigate volatility.

Positioning Hong Kong as a Crypto Hub

Chan emphasized that the licensing of stablecoins is a crucial step in fostering innovation within the financial sector. By creating a conducive environment for digital currency operations, Hong Kong seeks to attract both local and international businesses, positioning itself as a competitive player in the global cryptocurrency landscape.

Global Trends in Cryptocurrency Regulation

As countries worldwide grapple with the challenges posed by cryptocurrencies, Hong Kong's proactive approach sets it apart. Many jurisdictions are still in the early stages of developing regulatory frameworks, while Hong Kong aims to lead by example. The city's commitment to establishing a clear regulatory environment is expected to instill confidence among investors and businesses.

Implications for the Financial Sector

The introduction of stablecoin licenses is anticipated to have significant implications for Hong Kong's financial sector. Financial institutions and fintech companies will have the opportunity to explore new business models and services, leveraging the stability of stablecoins to facilitate transactions and enhance customer experiences.

Potential Challenges Ahead

While the move to regulate stablecoins is a positive development, challenges remain. The city must navigate concerns related to consumer protection, anti-money laundering regulations, and the overall stability of the financial system. Ensuring that stablecoin issuers maintain adequate reserves and comply with regulatory requirements will be critical to the success of this initiative.

Looking Ahead

As March 2024 approaches, stakeholders in the cryptocurrency market are eagerly awaiting further details on the licensing process. The Financial Secretary's announcement has sparked discussions among industry leaders, investors, and regulators, all keen to understand how these new regulations will shape the future of digital currencies in Hong Kong.

Conclusion

Hong Kong's decision to issue stablecoin licenses marks a pivotal moment in the evolution of the cryptocurrency market. By embracing innovation while prioritizing regulatory oversight, the city aims to strike a balance that fosters growth and protects consumers. As the global financial landscape continues to evolve, Hong Kong's actions will be closely watched by other jurisdictions looking to navigate the complex world of digital currencies.